LiteForex Malaysia Review 2023

Liteforex is an ECN broker that accepts traders based in Malaysia. But they are not well regulated, and their customer support is also not reliable. Read our review before you open account with Liteforex.

LiteForex is an ECN forex broker that accepts clients from Malaysia. They also have a Malay language website for Malaysian traders.

LiteForex was founded in 2005 & is registered in the Marshall Islands and is regulated under the Business Corporation Act. A group entity of LiteForex for European traders is licensed by the CySEC (Cyprus Securities and Exchange Commission).

LiteForex offers Islamic accounts also. They offers 2 account types: ECN and Classic. These accounts can be converted into Islamic accounts upon request. Additionally, Liteforex also offers a demo account.

This broker offers both MetaTrader 4 and MetaTrader 5 trading platforms. Further, they also have a proprietary mobile trading platform which is available on both Android and iOS.

LiteForex provides a range of major and minor currency pairs, and CFDs on oil, metals, indices, stocks, and cryptocurrencies for trading.

We compared all the pros & cons of Liteforex Malaysia, and give our verdict too. Read on.

LiteForex Malaysia Pros

- Liteforex has their website & support available in Malay.

- MT4, MT5 are available, plus they have their own proprietary trading platform.

- LiteForex offers Negative Balance Protection through ECN account.

- They also offer an Islamic account.

- CFDs on cryptocurrencies is available.

LiteForex Malaysia Cons

- LiteForex is considered to be unsafe for Malaysian traders due to low regulation.

- During our tests for this review, their customer support through live chat was found to be unresponsive.

- Liteforex does not have a local office in Malaysia.

LiteForex Malaysia – A quick look

| 👌 Our verdict on LiteForex | #11 Forex Broker in Malaysia |

| 🏦 Broker Name | LiteForex Malaysia |

| 💵 Typical EUR/USD Spread | 0.1 pips (with ECN Account) |

| 📅 Year Founded | 2005 |

| 🌐 Website | https://www.liteforex.com/ms/ |

| 💰 LiteForex Malaysia Minimum Deposit | $50 |

| ⚙️ Maximum Leverage | 1:500 |

| ⚖️ LiteForex Regulations | CySEC |

| 🛍️ Trading Instruments | Major & minor currency pairs, CFDs on currency pairs, oil, metals, indices, NYSE CFDs, NASDAQ CFDs, and cryptocurrencies. |

| 📱 Trading Platforms | MT4, MT5 & proprietary trading app. |

Is LiteForex Malaysia Regulated?

LiteForex broker has been operating since 2005 and caters to traders around the world. However, LiteForex is not a well-regulated broker.

The company is registered in the Marshall Islands and are subject to the local laws which includes the Business Corporation Act.

Additionally, a group entity of LiteForex, is regulated by the Cyprus Securities and Exchange Commission (CySEC) under the name Liteforex (Europe) Ltd. The company holds the license no. 093/08.

Overall, we do not consider LiteForex to be a safe broker for Malaysian traders, since the Marshall Islands is not reputable for its forex regulations.

LiteForex Malaysia Fees

LiteForex’s fees depend on a number of factors, mainly it depends on the instrument being traded & the account types that you open.

Here is a breakdown of trading & non-trading fees at LiteForex Malaysia

Low Floating Spread – LiteForex charges a floating spread that depends on a variety of factors including the type of account being used. The floating spread starts at 0 pips for traders using the ECN account and 1.8 pips for traders using the Classic account.

For example, the EURUSD benchmark currency pair is being traded at a spread of 0.1 pip through ECN accounts at the time of writing this review. Similarly, the EURUSD benchmark currency pair is being traded at a spread of 3 pips through the Classic account at the time of writing this review

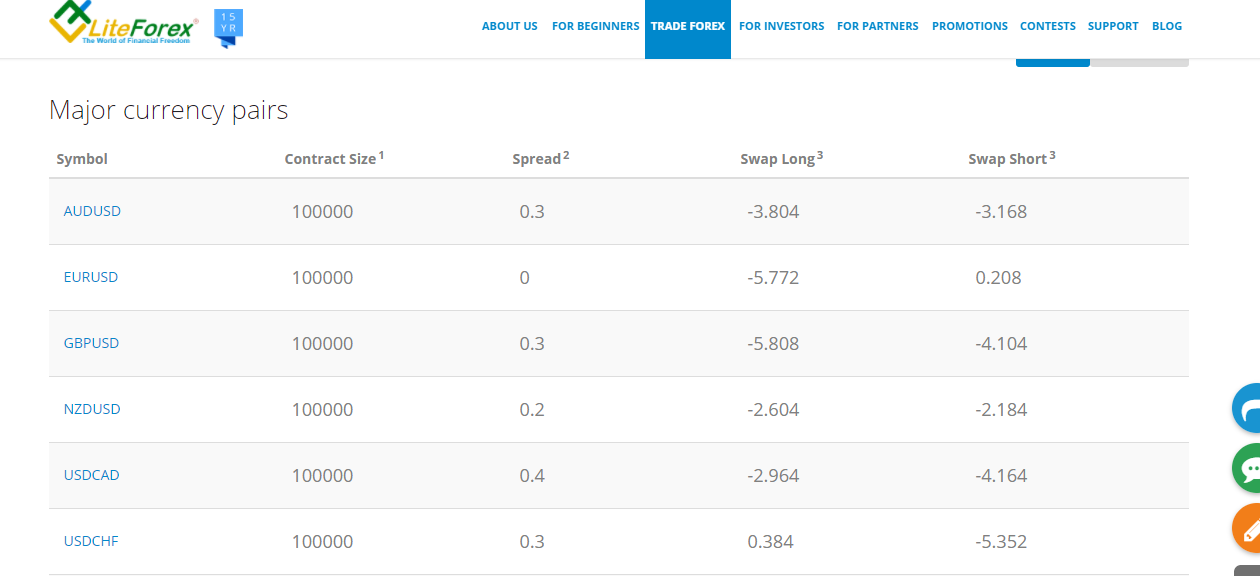

We show below in a screenshot, the real-time spread being charged for trading forex instruments through an ECN account.

No Commission Through Classic Account – LiteForex does not charge a commission for traders using their Classic Account. However, ECN Account traders will be charged a commission from $0.5 per mini lot. The commission depends on the type of instrument being traded.

For major forex pairs, the commission charged is $10 per lot. For minor forex pairs, the commission charged is $30 per lot.

Deposit and Withdrawal Fees – LiteForex does not charge any deposit or withdrawal fees from its traders. However, a commission or fee may be charged by the payment service provider. LiteForex also has a client loyalty program which refunds certain fees charged by various payment service providers.

Overall, we consider LiteForex to be a medium-cost forex broker. They charge a commission per trade through their ECN accounts. Also, the spreads that they charge through their Classic account is quite high. But it should be noted that they do not charge a deposit or withdrawal fee.

LiteForex Bonus

LiteForex has no active bonus offers for traders in Malaysia currently. But, LiteForex runs contests, and the bonus offers and contests that are currently available are listed below.

Payment System Fees Reimbursement – If a trader makes a deposit into their trading account, LiteForex will reimburse the fees that are charged by the payment services provider. This means that a deposit can be made without any fees being incurred by the trader.

LiteForex Dream Draw – LiteForex is currently organizing a raffles contest for traders. In order to participate, a trader needs to deposit a minimum amount of $500 and also trade at least 10 lots after the deposit. The prizes available include a house, a car, and 18 different gadgets.

Forex Video Blogger – LiteForex is currently holding a contest for video bloggers. Any video blogger who wins the contest will win a prize of $1000. The blogger needs to make a video on LiteForex (which can be a review, forecast, or lesson) and post the video on YouTube. Video bloggers may also receive a three-year contract to work for LiteForex.

Forex Demo Contest – Demo traders who perform the best during a one month period will stand the chance to win a prize pool of $1000. Traders need to show the best profitability while at the same time manage risk.

LiteForex Deposit and Withdrawal

LiteForex offers a wide variety of ways in which traders from Malaysia can deposit or withdraw their funds. LiteForex does not charge any deposit or withdrawal fees.

Here is a breakdown of the various ways in which Malaysian traders can deposit their funds.

Credit or Debit Cards – LiteForex can deposit their money through their bank credit or debit cards. LiteForex accepts Visa and MasterCard. The minimum amount that needs to be deposited is $10.

Wire Transfer – Traders can make a wire transfer through their bank account. The minimum amount that needs to be transferred is $100.

Local Deposit – LiteForex also allows local bank transfers to be made. The minimum amount that needs to be transferred is $1. The transfer needs to be made through LiteForex’s representative in Malaysia.

Payment Wallets – LiteForex accepts deposits from a wide variety of payment wallets including Skrill, Neteller, Perfect Money, Boleto Bancario, WebMoney, AdvCash, and AliPay. The minimum deposit needs to be between $1 to $10 depending on the wallet being used.

Cryptocurrencies – LiteForex also accepts payments via cryptocurrencies. It accepts Bitcoin, Ethereum, Monero, and Litecoin.

The time taken to process the deposit or withdrawal depends on the mode of the payment.

LiteForex Account Types

LiteForex offers two account types to traders based in Malaysua. These are the classic account and ECN account.

Both classic and ECN accounts can be converted into Islamic account by request.

Below we compared the differences between each account types offered by LiteForex.

Islamic Account – The Islamic account is available to Islamic traders. Traders need to make an application on the LiteForex website to get their account converted into an Islamic account. Under an Islamic account, no interest is charged for carrying positions overnight.

ECN Account – The ECN account allows traders to trade without any conflict of interest. The minimum deposit that needs to be made is $50. The leverage offered under this type of account is a maximum of 1:500.

A commission is charged for each trade depending on the type of instrument being traded. The account provides negative balance protection. A social trading platform is also available for traders to use. The account base currency can be USD, EUR, or MBT.

Classic Account – The Classic account is a market maker account offered by LiteForex. The minimum deposit required is $50. The maximum leverage offered under this account is 1:500. There is no commission charged per trade, however, the spread is considerably higher (compared to the ECN account).

This account does not provide negative balance protection hence, traders should implement appropriate risk mitigation strategies when using this type of account. Social trading is also available.

How to Open Account with LiteForex Malaysia

To open a trading account with LiteForex in Malaysia, traders need to follow these 5 steps:

- Go to LiteForex’s website.

- Choose your preferred account type.

- Fill in your personal details.

- Verify your identity and documents.

- Deposit funds and start trading after approval.

LiteForex Trading Instruments

LiteForex offers a decent range of trading instruments to its traders. Traders can access major currency pairs, minor currency pairs, oil, metals, indices, NYSE CFDs, NASDAQ CFDs, and cryptocurrencies.

Unlike many forex brokers, LiteForex offers access to cryptocurrencies. When compared to other brokers in Malaysia like Hotforex, OctaFX which offering similar features, the range of instruments offered by LiteForex is average.

LiteForex Trading Platforms

LiteForex offers the MetaTrader 4, MetaTrader 5, and their proprietary mobile trading platform.

MT4 and MT5 – The MetaTrader 4 and MetaTrader 5 are highly popular trading platforms that are offered by numerous forex brokers. They have a wide variety of functions and are highly customizable. These trading platforms are available on desktops (both Windows and Mac), smartphones (both Android and iOS), iPad, and web browsers.

Mobile Trading – In addition to the MT4 and MT5, LiteForex also offers its proprietary mobile trading platform. This app provides access to daily analysis, trading signals, and strategies. These app is available on both Android and iOS. It is available in more than 8 languages.

LiteForex Customer Support

LiteForex offers a few ways in which customers can get in touch with them. Customers can contact Liteforex’s customer support executives through live chat, email, and a feedback form.

The live chat option is available 24 hours a day on all weekdays (GMT +2). Traders can contact the general customer inquiries department, partnership department, and financial department. In order to access the live chat option, traders must open an account with LiteForex.

While writing this review, we tried to use the live chat customer support system. However, there was no response from the customer support team even after 2 hours.

Traders can also use the frequently asked question section of the website. However, the FAQs section is quite limited and most queries that a trader might have are not answered.

Traders can get in touch with LiteForex’s customer team through email as well. The email ID is provided on the website and is meant for general customer queries.

LiteForex does not provide a phone line for Malaysian traders to call for customer support.

Do We Recommend LiteForex Malaysia?

No, we do not recommend LiteForex for traders based in Malaysia.

The primary reason for not recommending LiteForex is that they are much less regulated than other similar brokers. They are only registered in the Marshall Islands while a group entity is licensed by the CySEC for European traders.

Also, the live chat option for customer support was found to be unhelpful since there was no response to our queries.

There are a few pros to trading with LiteForex as well. They are a medium-cost broker and they offer ECN services under their ECN account. They have a Malaysian translated website which is available in Malay.

They offer Islamic accounts that does not charge rollover interest. They offer the MetaTrader 4 and MetaTrader 5 trading platforms along with their own proprietary platform. Further, they provide access to a range of cryptocurrencies.

Overall, we do not recommend LiteForex to Malaysian traders due to safety concerns.

FAQs on LiteForex Review

Is LiteForex a trusted broker?

LiteForex broker is regulated with Marshall Islands & CySEC. But we are not considering LiteForex a safe broker for Malaysian Trader due to lack of much client’s protection measures.

How to withdraw money from LiteForex?

LiteForex offer variety of payment methods like credit/debit cards, E-Wallets Neteller, Skrill and Bank Wire Transfer. You will receive withdrawal on same method that was used to fund the account.

What is the minimum deposit for LiteForex?

The minimum deposit for LiteForex is $50 with their ECN or Classic account. They offer tight floating spread as low as 0 pips with Classic account.

LiteForex Kenya