There are two primary types of forex brokers. These are ECN brokers and market maker brokers.

With the advancement of financial technology, regular traders (also called retail traders) can now access the forex market.

Initially, only large financial institutions had access to the forex market, however, no liberal regulations allow retail traders to take part in it as well. The forex trading market has been gaining in popularity amongst retail traders since it is the largest and most liquid market in the world.

To trade in the forex market, traders need to sign up with a forex broker.

Here is a list of the best ECN brokers that accept clients from Malaysia. We also discuss how to choose an ECN broker and how to identify if a broker is ECN or market maker along with answering a few FAQs.

Comparison Table of Best ECN Brokers in Malaysia

| Forex Broker | Minimum Deposit | Lowest EUR/USD Spread | Regulation(s) | Max. Leverage | Available Instruments | Visit |

|---|---|---|---|---|---|---|

|

Minimum Deposit: $100

|

Lowest EUR/USD spread*: 0.7 pips

|

Regulation(s): CySEC, FSA

|

Max. Leverage:

1:500 |

Available instruments: 28 currency pairs, 10+ CFDs on Indices. Cryptos, Metals

|

Visit Broker | |

|

Minimum Deposit: $5

|

Lowest EUR/USD spread*: 0.6 pips

|

Regulation(s): FCA, FSCA, CySEC

|

Max. Leverage:

1:1000 (with Micro account) |

Available instruments: 49 currency pairs, and 100+ CFDs

|

Visit Broker | |

|

Minimum Deposit: $100

|

Lowest EUR/USD spread*: 0.0 pips on Pro Account

|

Regulation(s): FSCA, CySEC, FCA, FSA

|

Max. Leverage:

1:500 |

Available instruments: 62 Currency pairs, CFDs on 2 Metals, 14 Stock Indices, 3 Commodities & 4 Bonds

|

Visit Broker | |

|

Minimum Deposit: $10

|

Lowest EUR/USD spread*: From 1.3 pips (with Standard Account)

|

Regulation(s): FCA, CySEC, FSCA

|

Max. Leverage:

1:2000 |

Available instruments: 62 currency pairs, and several CFDs on spot metals, stocks, commodities, indices, and cryptocurrencies.

|

Visit Broker | |

|

Minimum Deposit: $200

|

Lowest EUR/USD spread*: From 1 pip (with Standard Account)

|

Regulation(s): ASIC, FCA, CySEC, DFSA, CMA, SCB, BaFin

|

Max. Leverage:

1:500 |

Available instruments: 60+ currency pairs, indices, commodity CFDs, share CFDs, cryptocurrencies, and currency indices.

|

Visit Broker | |

|

Minimum Deposit: $200

|

Lowest EUR/USD spread*: 0.1 pips with Raw Spread Account

|

Regulation(s): ASIC, FSA, CySEC

|

Max. Leverage:

1:500 |

Available instruments: 60 currency pairs, CFDs on 23 indices, over 19 commodities, more than 200 stocks, 6+ bonds, 4 global futures, and cryptocurrencies.

|

Visit Broker |

Best ECN Forex Brokers in Malaysia

List of 6 best ECN forex brokers for traders in Malaysia:

- OctaFX Broker – Best ECN Broker in Malaysia

- HotForex – Best ECN broker with low fees

- Tickmill – Best ECN Broker with no deposit or withdrawal fees

- FXTM – Good ECN Broker with low minimum deposit

- Pepperstone – Best ECN Broker with Negative Balance Protection

- IC Markets -Best ECN Broker that offer Islamic account

We have brought you a breakdown of each ECN broker in our list. Let’s check it out.

#1 OctaFX Forex Broker – Best ECN Broker in Malaysia

Regulations: CySEC, FSA

Minimum Deposit: $100

Available Platforms: MT4, MT5, cTrader for desktop, web & mobile

OctaFX was founded in 2011 and provides forex and CFD broking services. They are a reputable broker and have provided services to more than 1.5 million trading accounts. They have also received 28 industry awards for their services.

1) Safety: In comparison to other similar brokers, they regulated by fewer financial authorities. However, traders should note that they are regulated by the Cyprus Securities and Exchange Commission (CySEC) which is a tier-2 financial regulator.

2) Account Types: With OctaFX, traders have the option of choosing between three primary types of accounts. These are ECN account, Pro account, and Micro account. After opening any of these accounts, Islamic traders can request that their account be converted into an Islamic (Swap-free) account which does not charge overnight interest. All the three account types provide market execution.

3)Trading Instruments: OctaFX offers a range of 28 different currency pairs along with several other types of instruments. Their fees are generally affordable.

4) Fees: Their typical spread for trading the EURUSD benchmark currency pair through their Micro account is 0.7 pips.

#2 HotForex – Best ECN broker with low fees

Regulations: FCA, DFSA, FSCA, FSA.

Minimum Deposit: $5

Available Platforms: 53 currency pairs, CFDs on 6 metals, 4 energies, several indices, more than 56 shares, 5 commodities, 12 cryptocurrencies, 3 bonds, and 34 ETFs.

Hotforex is a famous forex broker that has been in business for upwards of 10 years. They accept traders from Malaysia and have been the recipient of more than 45 industry awards. They also provide their services in Malay.

1) Safety: Hotforex is a highly regulated broker. In addition to other regulators, Hotforex is licensed to operate by the tier-1 financial authority FCA of the UK.

2) Fees: Overall, Hotforex is an affordable broker. The typical spread for trading the benchmark EURUSD currency pair is 1.2 pips. They do not charge any deposit or withdrawal fee or any inactivity fee.

3) Trading Platforms: With Hotforex, traders have the option to choose between the MetaTrader 4 and MetaTrader 5 trading platforms. Each of these trading platforms are available on smartphones, computers, tablets, and web browsers.

4) Trading Instruments: Hotforex offers a choice of more than 50 currency pairs along with other types of trading instruments.

5) Trading Accounts: Overall, Hotforex offers a selection of seven different account types. These include Islamic, Zero Spread, Premium, Micro, HFCopy, PAMM, and Auto.

#3 Tickmill- Best ECN Broker with no deposit or withdrawal fees

Regulations:FSCA, CySEC, FCA, FSA.

Minimum Deposit: $100

Available Platforms: MT4 (MetaTrader4), WebTrader

Tickmill was founded in 2014 and has already made a name for itself in the forex space. This broker caters to more than 350,000 registered traders from across the world. They also have a dedicated website for Malaysian traders which can be read in Malay.

1) Safety: Tickmill is highly regulated. They are licensed by the FCA of the UK which is a tier-1 financial authority. Additionally, they are regulated by the CySEC of Cyprus, FSA of Labuan, FSCA of South Africa, and the FSA of Seychelles.

2) Fees: Tickmill charges a tight variable spread. The typical spread for trading the benchmark EURUSD currency pair is 0.1 pips. Tickmill charges a commission under its Pro account and VIP account. The commissions are $2 per side per 100,000 traded and $1 per side per 100,000 traded respectively.

3) Trading Accounts: With Tickmill, traders have the option of choosing between the PRO, VIP, and Classic accounts. Tickmill also offers Islamic accounts. Any account can be converted into an Islamic swap free account upon requesting customer support. The trading conditions of the Islamic account will depend on the base account type opened by the trader.

4) Trading Instruments: In total, Tickmill offers a wide range of more than 60 currency pairs in addition to other types of instruments.

#4 FXTM – Good ECN Broker with low minimum deposit

Regulations: FCA, CySEC, FSCA.

Minimum Deposit: $10.

Available Platforms: MT4, MT5 for desktop, tablet, web & mobile along with FXTM Trader.

FXTM is another reputable global forex and CFD broker that accepts traders from Malaysia. They also provide their services in Malay.

1) Safety: FXTM is relatively well-regulated and they are licensed to operate by the Financial Conduct Authority (FCA) of the United Kingdom.

2) Trading Instruments: Traders have the option of trading a large variety of instruments which includes 62 currency pairs. Their selection of currency pairs is wider than most comparable brokers.

3) Trading Platforms: With FXTM, traders can choose between the highly popular MetaTrader 4 and MetaTrader 5 trading platforms. Additionally, traders can use their proprietary trading platform called FXTM Trader.

4) Accounts: FXTM provides two primary account types. These are the ECN Account and Standard Account. By requesting customer support, traders can convert their account into an Islamic swap free account. The underlying trading conditions of the account will remain the same.

They do not have a local office Malaysia. Traders should also be aware that they charge hidden fees such as a withdrawal fee and a deposit fee.

#5 Pepperstone – Best ECN Broker with Negative Balance Protection

Regulations: ASIC, FCA, CySEC, DFSA, CMA, SCB, BaFin.

Minimum Deposit: $200.

Available Platforms: MT4, MT5, cTrader for desktop, tablet, web & mobile.

1) Safety: Pepperstone is regulated by both the ACIS of Australia and the FCA of the UK. They are both tier-1 financial authorities and therefore Pepperstone is considered to be a very safe broker.

2) Fees: Pepperstone charges decent rates for its services. The spread for trading the benchmark EURUSD currency pair is usually between 1 to 1.2 pips.

3) Trading Accounts: Pepperstone offers two primary types of accounts. These are the Razor and Standard accounts. Each of these types of accounts can be converted into an Islamic swap free account by requesting customer support. The standard account is ideal for new traders whereas the Razor account is meant for scalpers. Both the account types offer straight through processing (STP).

4) Trading Platforms: A range of trading platforms is available for traders using Pepperstone. Traders have the choice between MetaTrader 4, MetaTrader 5, and cTrader. Further, they also offer social trading tools.

A drawback is that Pepperstone does not offer its services in Malay and do not have a dedicated website for Malaysian traders.

#6 IC Markets – Best ECN Broker that offer Islamic account

Regulations: ASIC, FSA, CySEC.

Minimum Deposit: $200.

Available Platforms: MT4, MT5 for desktop, tablet, web & mobile along with cTrader.

IC Markets was founded in 2007 and is one of the earliest retail brokers in the forex industry. They accept clients from Malaysia and their trading website can be read in Malay. They have their head office in Australia.

1) Safety: IC Markets is considered a safe broker to trade through as they are licensed to operate by the tier-1 financial authority ASIC of Australia. Additionally, the broker is regulated by the CySEC of Cyprus and the FSA of Seychelles.

3) Trading Accounts: In total, IC Markets offers three primary types of accounts. These are the Standard, cTrader, and Raw Spread accounts. The Raw Spread and Standard accounts can be converted into swap free accounts. IC Markets also offers trial demo accounts for new users where they can practice their trading strategies.

4) Trading Platforms: Traders with IC Markets can choose between the MetaTrader 4, MetaTrader 5, and cTrader trading platforms. Each of these platforms can be used through smartphones, computers, and web browsers.

How to Choose an ECN Broker?

1) Regulation & Safety of Funds: When choosing an ECN broker, traders should be careful of the trading licenses held by the broker. If a broker is licensed by reputable financial authorities, then they may be considered safe.

Additionally, traders should check if the broker practices segregation of funds. This means that the funds of traders are kept in a separate account from the funds of the broker.

2) Check Hidden Fees: Traders should also be careful about hidden fees. A number of brokers are not upfront about the fees that they charge. A trader may realize that they are being charged fees that they did not know about when they opened their account.

These hidden fees are usually in the form of deposit fees, withdrawal fees, inactivity fees, and so on.

3) Check Spread and Commission: Traders should also check the average spread and commission charged by a broker. It is better to have tighter spreads. In order to get an idea of the fees charged by a broker, a trader can usually rely on the spread for trading the benchmark EURUSD currency pair.

For example, here is the typical spread charged Pepperstone by as shown on their website.

Other important factors that need to be checked include the quality of customer support offered by the broker, the bonuses offered by the broker, the trading platforms available, the languages offered, and whether they have a local office.

How to Identify if a Broker is ECN?

There are a number of ways to check if a broker is an ECN broker. The first step is to browse their website. They will usually mention if they are an ECN broker or a market maker in the “about” page of their website.

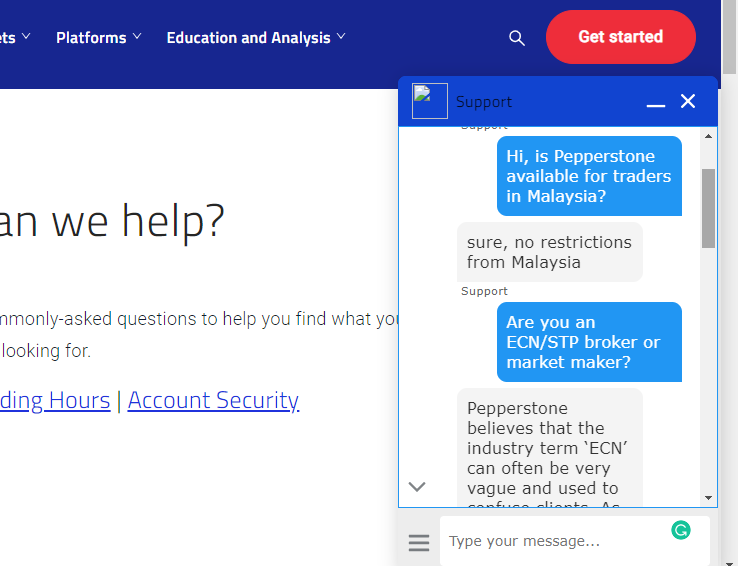

In case no information is available on the website, then traders should contact the customer support team. This can be done through live chat, email, phone call, or a contact form available on their website. The quickest way is to open a live chat, however, not every broker provides that option.

For example, here is a screenshot of the Pepperstone live chat where we asked them about their ECN services.

Frequently asked questions

What is the difference between ECN and Market Maker broker?

An ECN (or Electronic Communication Network) broker provides direct access to other market participants through interbank trading prices. This allows a trader to find a counterparty for their trades. In contrast, a market maker sets the bid and ask prices for a trade through its own systems.

Hence, there is no conflict of interest when trading with an ECN broker. A market making broker will lose money if a trader has a winning position and vice versa.

Do ECN brokers charge more?

An ECN broker may require you to have a higher minimum deposit. They may also charge higher trading fees, this is because opening and closing an ECN trade can be more expensive at ECN brokers than a market makers. Ex: Some ECN brokers charge $8/lot + spread for roundturn trade, which is almost the same as the spread that some brokers like 0.9 pips spread for EURUSD that market maker broker XM charge with their Ultra Low account.

Is their a risk of greater of slippage and requotes?

Is there a risk of slippage and requotes with ECN account?

Yes, trading with an ECN broker may expose a trader to a greater risk of slippage and requotes. Since ECN brokers rely on external liquidity, there is no guarantee that a client’s trades will be matched instantly. Usually, this happens during times of low liquidity or high volatility. What some market maker brokers offer instant order execution.