XM Malaysia Review 2023

XM is our #3 ranked forex broker for Malaysia traders. Well regulated, low spread with Ultra Low account, wide instruments are their pros. But XM does not have a Malaysian phone number.

XM is a well-established Market Maker forex broker that was founded in 2009, and they accept traders from Malaysia. XM provides its services in more than 30 languages including Malay & English.

The XM website is run by ‘XM Global’ which is a company registered in Belize and licensed by the IFSC. The XM Group companies are regulated by reputable financial authorities such as the ASIC (Australia), CySEC (Cyprus), and DFSA (UAE). So, they are considered a safe broker.

XM Forex broker gives traders the option to choose between 4 different account types which are: Micro Account, Standard Account, XM Ultra Low Account, and Shares Account. XM also offers Islamic account services for those who have subscribed to the Micro, Standard, XM Ultra Low account types.

The trading fees at XM depend on the type of account that you open. XM offers you the option of using the MetaTrader 4 or MetaTrader 5 trading platforms that are available for smartphones, desktops, web browsers, and tablets.

XM offers Malaysian traders the opportunity to trade 55+ currency pairs and CFDs on 1000+ stocks, commodities, equity indices, precious metals, and energy.

In this XM Malaysia review, we discuss the pros and cons of this broker, how safe they are, the fees charged by them, their trading conditions, customer support, and everything else you need to know.

XM Malaysia Pros

- XM is a Market Maker broker, however, they claim that they do not benefit from client losses. So there is no conflict of interest.

- They do not charge deposit or withdrawal fees on any method.

- XM offers Negative Balance Protection to traders in Malaysia

- They are regulated by the Tier- 1 ASIC (Australia) Financial Authority, Tier-2 CySEC, in addition to other reputable financial authorities. Hence, it is considered safe to trade through them.

- They offer an Islamic account to Malaysian traders.

- They offer a wide variety of instruments to trade.

XM Malaysia Cons

- XM does not have a proprietary trading platform, they only offer MT4 & MT5.

- They do not have an office in Malaysia.

XM Malaysia – A quick look

| 👌 Our verdict on XM | #3 Forex Broker in Malaysia |

| 🏦 Broker Name | XM Malaysia |

| 💵 Typical EUR/USD Spread | 1.7 pips (with Standard Account) |

| 📅 Year Founded | 2009 |

| 🌐 Website | www.xm.com/my/ |

| 💰 XM Malaysia Minimum Deposit | $5 |

| ⚙️ Maximum Leverage | 1:888 for Trades between $5 to $20,000 with Micro Account |

| ⚖️ XM Regulations | ASIC, CySEC, IFSC, DFSA |

| 🛍️ Trading Instruments | 55+ currency pairs, 1300+ stocks, 8 commodities, 10 indices, gold and silver, 5 energy CFDs, and 100 shares |

| 📱 Trading Platforms | MT4, MT5 for desktop, tablet, web & mobile |

Is XM Malaysia Regulated?

XM Global Limited, which is the company that runs the XM trading website, is registered in Belize with its registered address at No. 5 Cork Street, Belize City, Belize, CA.

XM Global Limited is authorized to provide trading services by the International Financial Services Commission (IFSC) and holds the license number 000261/106.

The XM Group companies are regulated by one Tier-1 financial regulator and other reputed financial authorities. The group first started its operations in 2009 and has catered to millions of clients across the world.

XM is regulated and licensed by the following financial authorities:

- XM is registered with the Cyprus Securities and Exchange Commission (CySEC) under the name ‘Trading Point of Financial Instruments Limited’ – and holds the license number 120/10

- XM is registered with the Dubai Financial Services Authority (DFSA) under the name ‘Trading Point MENA Limited with license number F003484.

- XM is registered and licensed by the Australian Securities and Investment Commission (ASIC) under the name ‘Trading Point of Financial Instruments Pty Ltd’ with license number 443670.

XM is considered a safe forex broker for Malaysian traders.

In addition to being regulated by multiple reputed financial authorities, XM also maintains safe practices such as segregation of funds and also offers negative balance protection.

XM Malaysia Fees

XM is a variable spread broker, and they only charge spread with 3 Forex Trading accounts. XM charges commissions only with their Shares account types.

The exact spread that is charged by XM Malaysia depends on the type of account the trader is holding, the instrument that is being traded, and the time when the trade is being made.

To give traders an idea of the fees that are charged, we will be using a few benchmark examples for this review.

Here is a breakdown of trading & non-trading fees at XM Malaysia:

- Tight Variable Spreads – XM offers fractional pip pricing, which gives traders more accurate spreads for their trades. The exact spread depends on the instrument being traded, and trader’s account type.

For example, the average spread charged for trading the benchmark EURUSD currency pair through their standard account is 1.7 pips.

- Variable Commission with Shares Account – XM does not charge any commission under the Standard, Micro, and Ultra Low account types. Commission is charged for traders using the Shares account.

The commission that XM charges depends on the type of shares that you are trading. They also charge a minimum commission per transaction. For example, if you’re looking to trade US-based shares, then you will be charged $0.04 commission per share with a minimum commission of $1 per transaction.

- Zero Deposit and Withdrawal Fees – XM does not charge any deposit or withdrawal fee. Additionally, they cover the fee charged by e-wallets and major credit cards. Wire transfers above $200 are also covered.

- Inactivity Fee after 3 Months – If an account is dormant for a period of more than 90 calendar days, then the trader will be charged an inactivity fee of $5 per month. If the remaining balance in the account is less than $5 then the full balance will be charged. There is no charge for accounts holding no account balance.

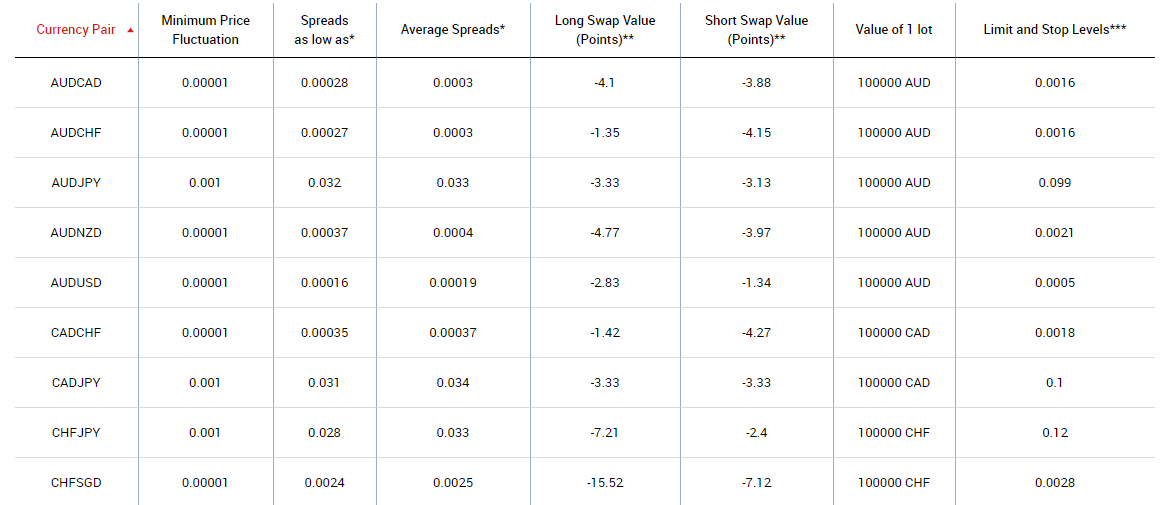

Here is a screenshot of the typical spread charged for various currency pairs with the Standard account at XM.

Overall, XM is a medium-cost broker. Their spreads with Standard account are average compared to other similar brokers. You should open an “Ultra Low” account for a lower spread.

They charge a minimum commission for every trade under their Shares account. They do not charge any deposit or withdrawal fee but they do charge an inactivity fee.

XM Bonus

XM bonus is available to traders in Malaysia. We reviewed XM Bonus promos, here is a breakdown of their active promotions.

XM Welcome Bonus – XM offers a deposit bonus of 15% up to a maximum limit of $500. They credit this bonus instantly and it is automatic for all traders. But traders cannot withdraw the amount of the bonus.

XM $30 Bonus – Malaysian traders can avail the $30 trading bonus at XM. This is a limited period bonus.

Loyalty Program – Traders will automatically earn XM Points which can be traded as credit bonus rewards. Traders are grouped into four different levels under the loyalty program and the XM points that are earned depend on that level.

Refer a Friend – Traders can earn up to $35 for referring a friend to XM. These earnings can be withdrawn from the account.

Seasonal Bonuses – In addition to the above bonuses, XM also offers various seasonal and occasional bonuses to its traders for limited periods of time. Certain bonuses are special invite-only bonuses as well.

XM Deposit and Withdrawal

XM offers a variety of ways to make deposits and withdrawals for traders in Malaysia.

Deposits and withdrawals can be made through multiple credit cards, multiple electronic payment methods, bank wire transfers, local Malaysian bank transfers, and other payment methods, along with local depositors.

Once a trader opens an account, they can log in to XM’s Members Area, select a payment method of their preference on the Deposits/Withdrawal pages, and follow the instructions given.

Remember that XM does not charge any fee for making a deposit or withdrawal. In addition to not charging a deposit or withdrawal fee, XM may also cover the fee charged by your payment service.

XM Account Types

XM offers four different types of accounts to traders in Malaysia. Each type of account has its own pros and counts and is suitable for different types of traders. For example, the Shares account is suitable for high-volume traders since it charges very low spreads and a commission per trade.

XM has a minimum deposit of 5 USD.

It is worth noting that XM does not offer MYR as the base currency under any type of account. Traders can use the USD or other base currencies depending on the type of account. The maximum leverage at XM is 1:888.

XM also offers an Islamic account option.

Here is a breakdown of the different types of accounts offered by XM.

XM Islamic Account – XM offers an Islamic account that does not charge any swap rates or overnight rollover interest. You can choose to make your trading account an Islamic account after you have opened an account with XM.

The Islamic account option is available to traders using the Micro, Standard, or Ultra Low account, and Shares account types. XM has also stated that they do not charge higher spreads from traders using Islamic accounts. Islamic accounts can have a leverage of up to 888:1. The trading conditions remain the same as other account types.

XM Micro Account – The spread under this type of account can be as low as 1 pip. The leverage offered can range from 1:1 to 888:1 for trades ranging between $5 to $20,000. The minimum account deposit is $5. XM does not charge a commission under Micro accounts.

Standard Account – The spread charged can be as low as 1 pip. The leverage offered can range from 1:1 to 888:1 for trades ranging between $5 to $20,000. The minimum account deposit is $5. XM does not charge a commission under Standard accounts.

XM Ultra Low Account – The spread under the Ultra Low account can be as low as 0.6 pip. The leverage offered can range from 1:1 to 888:1 for trades ranging between $50 to $20,000. The minimum account deposit is $50. There is no commission under Ultra Low accounts.

Shares Account – No hedging is allowed under this type of account. Traders are charged a commission per trade along with a minimum commission per transaction. The spread that is charged depends on the underlying exchange. You cannot avail any leverage under the Shares account. The minimum deposit for this account is $10,000.

How to Open Account with XM Trading

Below are simple steps to open an account with XM Trading:

- Visit Website: Go to XM Trading’s official website at www.xm.com.

- Sign Up: Click on “Open an Account” or “Register.”

- Fill Registration Form: Enter your personal details, including name, email, country, and other required information.

- Verify Email: Confirm your account registration by clicking on the verification link sent to your email.

- Submit Documents: Upload a valid government-issued ID and proof of address to verify your identity.

Once done with completing above steps and your documents are approved, you need to deposit funds into your account and start trading

XM Trading Instruments

XM offers the option to trade more than 55 currency pairs, 1300+ stocks, 8 commodities, 10 indices, gold and silver, 5 energy CFDs, and 100 shares.

Overall, XM offers a very large range of instruments for traders to choose from compared to other similar brokers. Their selection of Stock CFDs is especially high and XM is particularly suitable for traders looking to trade Stock CFDs.

However, they do not offer any cryptocurrencies for trading which is different from brokers such as HotForex.

XM Trading Platforms

XM is a MetaTrader-based forex and CFD broker.

Traders from Malaysia have the option of using either the MetaTrader 4 or the MetaTrader 5 trading platforms. Both platforms are popular with forex and CFD traders.

The MT platforms are available on smartphones, computers, web browsers, and tablets. Both the platforms have a Mac and Windows version for desktop users. The mobile apps of these platforms are available for both Android and iOS users.

The MT platforms are convenient to use and offer proper functionality for traders.

It should be noted that XM does not offer its own proprietary trading platform.

XM Customer Support

XM users in Malaysia can contact customer support through live chat, email, or by phone.

Customers can also read their FAQ section to find answers to their issues. The customer support team is available at all times during weekdays.

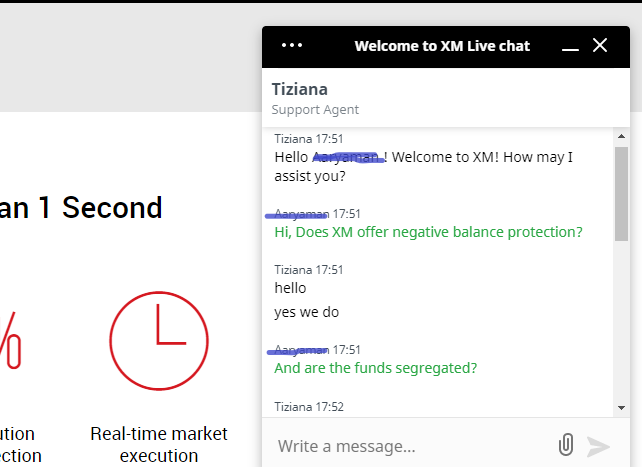

Good Live Chat Support – We used the English live chat support during the writing of this review and found it to be quick and helpful. The hold time before you are connected to a representative was below 2 minutes. They also answered your questions quite quickly. We found the entire process to be quite painless.

The Malay chat support is only available during business hours in Malaysia.

Email Support in Malay – Traders in Malaysia can contact them through their email “[email protected]” for Malaysian traders. While writing this review, we used their English email ID and it took three hours for them to provide a response.

No local phone number – Traders in Malaysia will need to contact their global phone lines +501 223-6696 for customer service. They do not have a local phone number that Malaysians can call.

Overall, we found XM’s customer support to be helpful, but we gave them 4 stars due to the unavailability of a local phone number. Still. they offer a variety of ways in which Malaysian traders can get in touch with them.

Do We Recommend XM Malaysia?

Absolutely, we recommend XM Forex Broker for traders in Malaysia.

XM is a reputable international broker that has a proven track record. They are safe to trade through considering that they are well regulated, and observe safety practices such as negative balance protection and segregation of funds.

They offer a very wide range of instruments to trade. However, they do not offer cryptocurrency CFDs. They do not have a proprietary trading platform, but the MT4 and MT5 trading platforms are quite popular with users.

They also offer Islamic accounts and they do not charge a wider spread for Islamic users.

The primary drawback to trading with XM is that they do not have offices in Malaysia. They also do not have a local phone number for Malaysian traders to call.

FAQs on XM Review

Is XM a good broker?

Yes. XM is a moderate risk Forex broker. XM is regulated with toper tier authorities FCA, ASIC, CySEC and client’s funds are segregated. So we consider them a safe broker.

What is the minimum deposit of XM?

The XM minimum deposit for opening a real trading account is $5. You can make deposit using all cards, bank wire transfer or E-Wallets.

How to withdraw Funds from XM?

XM withdrawal request can be submitted from the client panel. It will start showing pending instantly after submitting the request and will be completed within 24 hours. XM only process the withdrawal back to the source account which was used for deposit.

XM Forex Kenya