FxPro Malaysia Review 2023

One of the oldest Retail forex and CFD brokers. The accept Malaysia based traders, but there are some cons.

Founded in 2006, FxPro is a No Dealing Desk (NDD) forex and CFD broker. The company caters to clients in more than 170 countries, including Malaysia. They do not provide their services in Malay. The company was named the “Most Trusted Forex Brand, UK” by Global Brands Magazine.

FxPro and its group entities are regulated by reputed financial authorities. These authorities include the FCA of the UK, the CySEC of Cyprus, the FSCA of South Africa, and the Securities Commission of The Bahamas.

FxPro offers Islamic accounts for traders in Malaysia. A basic account can be converted into an Islamic account by requesting customer support. They also offer five types of accounts viz. the FxPro cTrader account, FxPro MT4, FxPro MT5, FxPro MT4 Instant, and FxPro (EDGE). Each type of account can be upgraded to a VIP account depending on trading volume and other factors. The trading platform that is available depends on the account type that you choose. In addition, they also offer demo accounts so that traders can test their strategies.

Overall, FxPro offers more than 260 instruments to its traders. This includes 70 major and minor forex pairs, metals, indices, futures, shares, and energies.

We are going to talk about everything noteworthy in our FxPro review for Malaysian traders. This review will particularly focus on the safety, fees, trading conditions, customer support, and more.

FxPro Malaysia Pros

- They offer MT4, MT5 and their own proprietary trading platforms.

- FxPro offers Negative Balance Protection to traders in Malaysia

- They are regulated by the Tier- 1 FCA (UK) Financial Authority, in addition to other reputable financial authorities. Hence, it is considered safe to trade through them.

- They offer an Islamic account to Malaysian traders.

FxPro Malaysia Cons

- They do not offer their services & support in Malay.

- They charge an inactivity fee.

- They do not have an office in Malaysia.

- They do not offer CFDs on cryptocurrencies or bonds.

FxPro Malaysia – A quick look

| 👌 Our verdict on FxPro | #16 Forex Broker in Malaysia |

| 🏦 Broker Name | FxPro Malaysia |

| 💵 Typical EUR/USD Spread | 1.2 pips |

| 📅 Year Founded | 2006 |

| 🌐 Website | https://www.fxpro.com/ |

| 💰 FxPro Malaysia Minimum Deposit | $100 |

| ⚙️ Maximum Leverage | 1:200 |

| ⚖️ FxPro Regulations | FSCA, CySEC, FCA, SC |

| 🛍️ Trading Instruments | 70 major and minor forex pairs, metals, indices, futures, shares, and energies. |

| 📱 Trading Platforms | cTrader, MT4, MT5 for desktop, tablet, web & mobile along with proprietary trading platforms. |

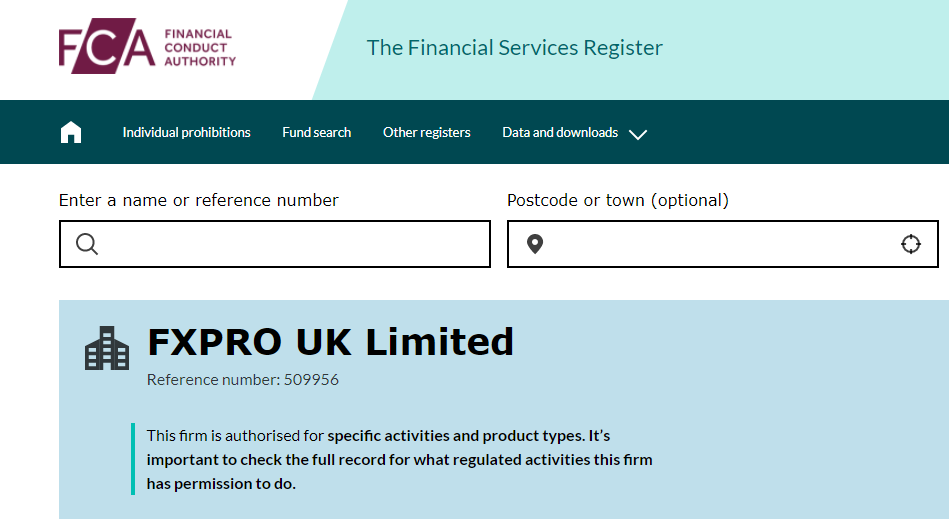

Is FxPro Malaysia Regulated?

FxPro is a reputed broker that has won several notable awards for its services. They were founded in 2006 and are one of the earliest retail forex brokers.

FxPro is regulated and licensed by the following financial authorities:

- FxPro is registered with the Financial Conduct Authority (FCA) of the UK under the name ‘FxPro UK Limited’and holds the registration number 509956

- FxPro is registered with the Cyprus Securities and Exchange Commission (CySEC) of Cyprus under the name ‘FxPro Financial Services Ltd.’ and holds the license no. 078/07.

- FxPro is registered with the ‘Financial Services and Conduct Authority (FSCA) of South Africa under the name ‘FxPro Financial Services Limited.’ and holds the authorisation number 45052.

- FxPro is registered with the ‘Securities Commission of The Bahamas under the name ‘FxPro Global Markets Limited’ and holds the license no. SIA- F184.

Traders from Malaysia who register with FxPro have the option to come under the jurisdiction of the Securities Commission of the Bahamas or the Cyprus Securities and Exchange Commission. This option can be found at the bottom of their website.

FxPro also offers a variety of safety practices which includes segregation of funds and negative balance protection.

Hence, we consider FxPro to be a safe broker to register with.

FxPro Malaysia Fees

FxPro charges a spread with all account types. They do not charge a commission under most account types. They only charge a commission when trading with the FxPro cTrader account type.

Here is a breakdown of the fees charged by FxPro.

Variable Spread – The overall spread charged depends on the account being used and the instrument being traded. The spread may also vary depending on market conditions at the time of trade. The spread can be as low as 0.6 pips when using the MT4 and MT5 accounts. The spread can be much lower when using the cTrader account, but a commission will be charged.

The average spread for trading the benchmark EURUSD currency pair while using the MT4 trading account is 1.2 pips. This typical spread is slightly higher than average when compared to other similar brokers.

No Commission – FxPro only charges a commission if traders use the cTrader account. The commission is only charged when trading forex pairs or metal CFDs. No commission is charged under the cTrader account when trading indices and energies.

The commission is $45 per $1 million that is being traded. The commission is charged when buying and selling both.

FxPro does not charge a commission when using the MT4 account, the MT5 account, the MT4 Instant account, or FxPro (EDGE) account.

No Deposit and Withdrawal Fees – For traders registered under the FxPro – Bahamas jurisdiction, FxPro does not charge any deposit or withdrawal fees. However, the payment service provider may charge a fee depending on their fee structure.

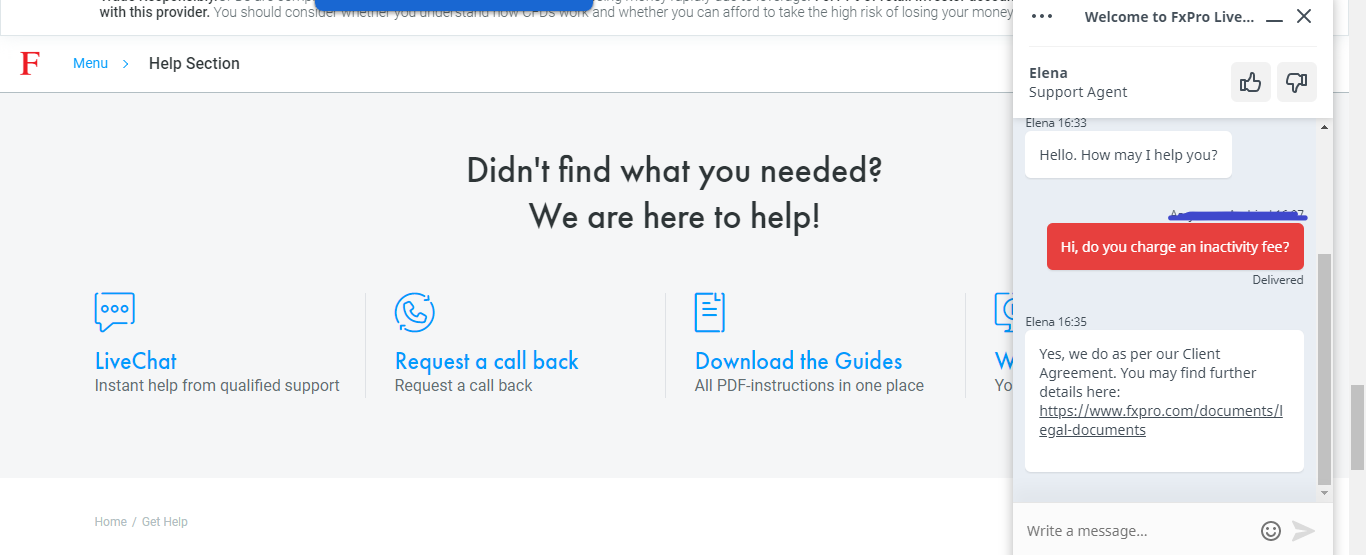

Inactivity Fee – FxPro does charge an inactivity fee as per their client agreement, depending on the jurisdiction of the trader.

Overall, we think that FxPro charges average fees when compared to other similar brokers. They do not charge a deposit or withdrawal fee from traders under the Bahamas jurisdiction, however, they do charge an inactivity fee.

FxPro Bonus

FxPro does not currently offer any promotional bonuses to its traders. However, the broker does have a partnership program that anyone can join. The partnership program offers up to 62.5% of spread revenue.

FxPro Deposit and Withdrawal

The deposit and withdrawal options offered by FxPro depend on your region or jurisdiction. FxPro allows traders to deposit and withdraw funds from a wide variety of methods. They do not charge a fee for fund transfer, however, a fee may be charged by the payment service provider.

Some of the deposit and withdrawal methods have been detailed below.

Bank Transfer – A bank transfer can take up to one working day for the money to reflect in your trading account.

Debit and Credit Cards – A deposit made through a debit or credit card will reflect within 10 minutes while a withdrawal may take up to one working day. FxPro accepts MasterCard, Visa, Maestro, and American Express.

Payment Wallets – The payment wallets include Skrill, Neteller, and UnionPay. A deposit will reflect in your account within 10 minutes while a withdrawal can take up to one working day.

FxPro Account Types

FxPro offers five primary types of accounts which are FxPro cTrader account, FxPro MT4, FxPro MT5, FxPro MT4 Instant, and FxPro (EDGE). Traders can also upgrade their account to a VIP account. FxPro also offers swap-free Islamic accounts to its traders.

The principal differences between each type of account can be found below.

Islamic Account – FxPro offers Islamic accounts for religious purposes. Traders can request to have their account turned into an Islamic account by contacting customer support or their Back Office Department. The trading conditions of the base account type will remain the same after the conversion.

Premium (VIP) Account – FxPro offers VIP accounts to traders who make high deposits (typically in the range of $50,000 or equivalent) and those who regularly make high-volume trades. There are certain advantages to having a VIP account such as the chance of lower spreads/commissions and free VPS services.

FxPro MT4 Account – This account allows traders to use the MetaTrader 4 desktop, MT4 Webtrader, or MT4 Mobile app. There is no commission but a variable or fixed spread is charged. Hedging is allowed while netting isn’t.

FxPro MT5 Account – As the name suggests, users of this account type can use the MetaTrader 5 suite of trading platforms. Netting is allowed and hedging is available on request. No commission is charged.

FxPro cTrader Account – cTrader suite of trading platforms can be used. There is no minimum stop level. Hedging is allowed. The spread is reduced but a commission is charged when trading forex pairs and metals. Indices and

energies are spread only.

FxPro MT4 Instant Account – Traders have the option of using any of the MT4 trading platforms. Traders have the advantage of a fixed spread for 7 major forex pairs. The execution speed is instant rather than market execution. There is no commission but a spread is charged. Hedging is allowed.

FxPro (EDGE) – Traders can use the proprietary trading platform of FxPro as well as MT4. Netting is not allowed while hedging is allowed. There is no commission. Trading costs consist of spreads.

How to Open Account with FxPro

Opening Account with FxPro is very simple. You need to follow the below steps for account opening:

- Visit Website: Go to www.fxpro.com.

- Register: Click “Register” or “Open Account.”

- Choose Account: Select the account type (MT4, MT5, cTrader).

- Fill Form: Enter personal info and verify email.

- Deposit & Trade: Fund your account and start trading.

Congratulations! Your account has been opened. Now you can start your trading.

FxPro Trading Instruments

Traders have access to more than 260 instruments when trading through FxPro. The range of trading instruments includes 70 major and minor forex pairs, metals, indices, futures, shares, and energies. FxPro does not offer any cryptocurrencies or bonds.

Overall, they offer an average variety of instruments when compared to other similar brokers.

FxPro Trading Platforms

FxPro offers a wide range of trading platforms for traders to choose from including MetaTrader 4, MetaTrader 5, cTrader, and their proprietary FxPro EDGE platform. The platform that is available depends on the type of account opened by the trader.

FxPro EDGE – The FxPro EDGE is FxPro’s own trading platform. It aims to be both convenient and full of features. It is available on both mobile and desktop. It offers more than 50 indicators and charting tools.

MetaTrader 4 – MetaTrader 4 is a classic trading platform in the forex space. It is easy-to-use and has customizable features. It is available on desktops, web browsers, and as a mobile app for both Android and iOS.

MetaTrader 5 – The MetaTrader 5 is an improvement upon the MetaTrader 5 and offers more advanced features. It has a greater number of indicators when compared to the MT 4. It is also available in all formats.

cTrader – The cTrader is a reliable trading platform that is chockful of features. The cTrader suite of platforms include cTrader Desktop, cTrader Webtrader, and cTrader mobile app.

FxPro Customer Support

FxPro has an extensive FAQs section that answers numerous questions that a trader might have. In addition, customers can contact their customer support team through live chat available on their website, phone call, or email.

Live Chat – Their live chat option directly connects you to a customer support executive. We tested their live chat system, and found the response to be quick and helpful. They respond to queries within 5 minutes.

Email – There is a dedicated email handle to answer customer support queries. Customers can reach out to them at any time.

Phone – FxPro does not have a local phone line for Malaysian traders to call. However, traders can request a call back through the website. There is also a global help line number that can be called for immediate help.

Do We Recommend FxPro Malaysia?

Yes, we recommend FxPro for Malaysian traders. FxPro is a highly reputed and safe broker to conduct trading activities with. They offer Islamic accounts. The trading instruments available is quite decent. Their customer support is quite helpful and quick. They offer a variety of trading platforms as well as their own proprietary trading platform.

There are a few cons to trading with them. They do not offer cryptocurrencies and bonds. Their services are not available in Malay. They charge an inactivity fee. They do not have offices in Malaysia.

Overall, we recommend FxPro because they are an established forex broker that is considered quite safe.

FAQs on FxPro Review

What is the minimum deposit for FxPro?

The minimum deposit of FxPro is $100 for all trading account. But they recommend all users or traders to start with minimum deposit of $1000.

How long does it take to withdraw from FxPro?

Once withdrawal request is approved, it may take up to 3-7 working days for the funds to reflect back in to your account for cards and up to 3-5 working days for bank wire depending upon the banks.

How to withdraw funds from FxPro?

Fund wityhdrawal request can be submitted from FxPro Direct Area. Any amount from trading account can be transferred to FxPro Wallet. You need to withdraw funds via the same method used to deposit.

FxPro Kenya