RoboForex Malaysia Review 2023

Roboforex is a CySEC licensed forex broker & they are popular in Malaysia. Their fees is not the lowest & they could do better in terms of safety of funds. See how they compare against other forex brokers.

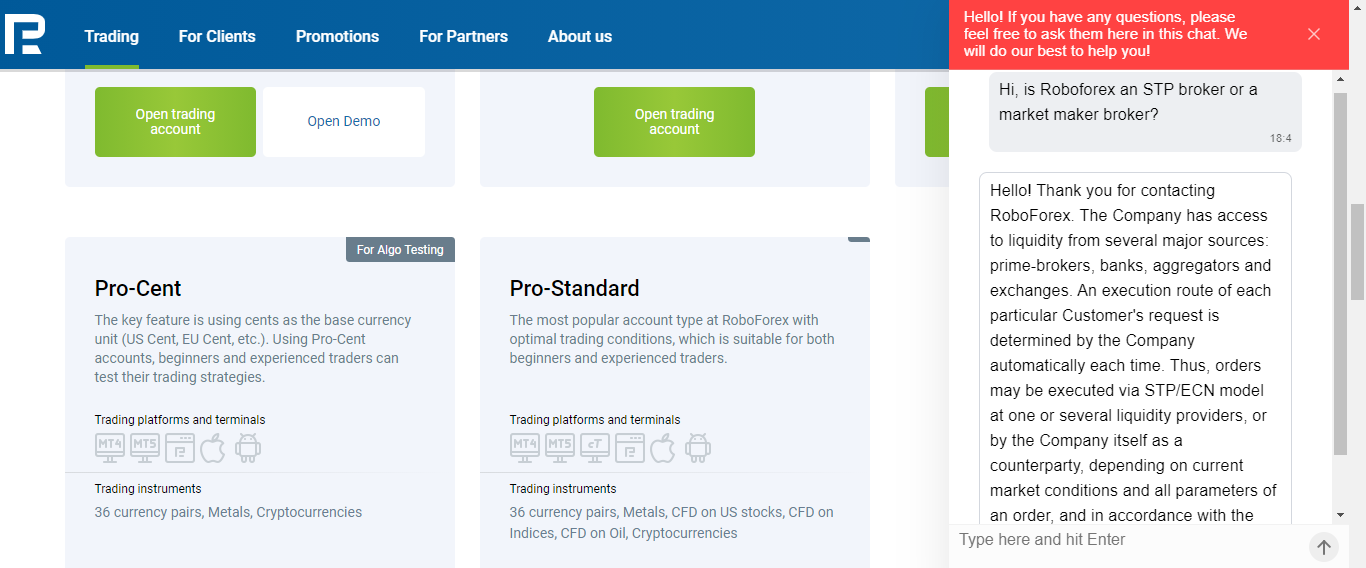

Roboforex is an online forex and CFD trading platform that accepts clients from Malaysia. The company was founded in 2009 and has its headquarters in Belize City. The company both ECN and market-making models depending on the prevailing conditions.

The company services more than 3 million accounts held by traders across the world. It has won numerous awards for its services including Best Investment Products (Global) at the 2020 Global Brands Magazine Awards and Most Trusted Broker at the 2020 International Business Magazine Awards.

Roboforex operates a dedicated website for Malaysian traders that is available in Malay. They also offer Islamic accounts. They offer five primary types of accounts to their traders which are the Pro-Cent, ECN, Prime, R Trader, and Pro-Standard accounts. They also offer a demo account through which traders can test their strategies.

This broker is less regulated than other comparable brokers. It is regulated by the IFSC which is the financial authority of Belize. It is also a member of the Financial Commission which is an international organization that resolves disputes between financial service providers and their clients.

Roboforex offers several trading platforms for traders to choose from. They offer the highly MetaTrader 4 and MetaTrader 5 platforms along with c Trader and their proprietary trading platform R Trader.

The broker provides access to a wide range of trading instruments. Traders using the R Trader account can access 12,000 trading instruments including currency pairs, stocks, commodities, indices, energies, metals, and cryptocurrencies. The exact instruments available depend on the type of account held by the trader.

In this Roboforex review, we will discuss everything you need to know about Roboforex before trading with them. We will cover the pros and cons, fees, trading platforms, accounts, trading instruments, customer support, and more.

Roboforex Malaysia Pros

- They offer a dedicated website for Malaysian traders and customer support is available in Malay.

- They offer MT4, MT5 and their own proprietary trading platforms.

- Roboforex offers Negative Balance Protection to traders in Malaysia

- They offer an Islamic account to Malaysian traders.

- They offer cryptocurrencies to trade.

Roboforex Malaysia Cons

- Roboforex is a market maker depending on the market conditions.

- They charge a withdrawal fee.

Roboforex Malaysia Summary

| 👌 Roboforex Verdict | #14 Forex Broker in Malaysia |

| 🏦 Broker Name | Roboforex Malaysia |

| 💵 EUR/USD Spread at Roboforex | 0.1 pips (with ECN Account) |

| 📅 Year Founded | 2009 |

| 🌐 Roboforex Website | https://www.roboforex.my/ |

| 💰 Roboforex Malaysia Minimum Deposit | $10 |

| ⚙️ Maximum Leverage | 1:2000 |

| ⚖️ Roboforex Regulations | IFSC |

| 🛍️ Trading Instruments | 12,000 trading instruments including currency pairs, stocks, commodities, indices, energies, metals, and cryptocurrencies |

| 📱 Trading Platforms | MT4, MT5 for desktop, tablet, web & mobile, cTrader, along with proprietary trading platforms. |

Is Roboforex Malaysia Regulated?

Roboforex has been in operation since 2009 and caters to clients across the globe. The company has won several awards for its services as well.

Roboforex is primarily regulated by the International Financial Services Commission (IFSC) of Belize. The company holds license number 000138/107.

The broker is also a member of the Financial Commission which is an international organization of financial service providers. The organization is also involved in resolving disputes between the members and their clients.

Additionally, Roboforex is also a participant of the Commission’s Compensation Fund. This provides insurance coverage of 20,000 euros to traders who are clients of Roboforex.

Also, Roboforex provides negative balance protection to its traders. This means that the funds in a trader’s account can never go below zero. Roboforex also implements segregation of funds practices. Client funds and company funds are kept in separate bank accounts.

Hence, we consider Roboforex to be a safe broker for Malaysian traders.

Roboforex Malaysia Fees

The fees charged by Roboforex depends on a variety of factors including the type of account held and the instrument being traded.

Hence, to give traders an idea of the kind of fees that are charged, we will be using certain benchmark examples.

Here is a breakdown of trading & non-trading fees at Roboforex Malaysia

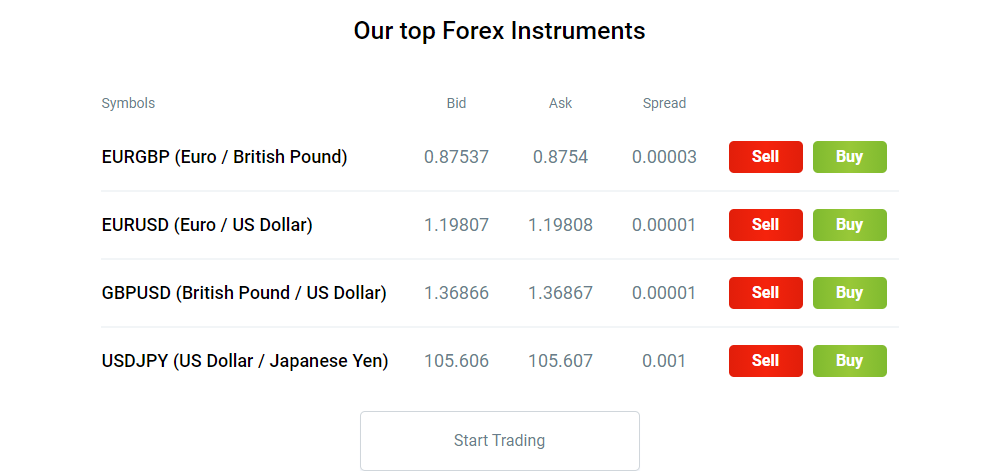

Tight Floating Spreads – The spread charged by Roboforex depends on the type of account, the timing of the trade, and the instrument being traded.

The spreads charged by Roboforex start from 0 pips for traders using the Prime and ECN accounts. The minimum spread is higher for traders using the R Trader, Pro-Cent, and Pro-Standard accounts.

For example, the typical spread charged by Roboforex for the EURUSD benchmark currency pair is 0.1 pips under the ECN account.

Here is the screenshot of the live spread being charged by Roboforex for major currencies.

No Commission from Certain Account Types – Roboforex does not charge a commission from traders using the Pro-Cent and Pro-Standard accounts. However, the minimum spread charged is considerably higher for these account types.

Roboforex does charge a commission for trading a volume of 1 million USD from the Prime and ECN accounts. The exact commission charged depends on the instrument being traded and the type of account being used.

For example, under the ECN account, the commission charged is 20/mio for trading the benchmark EURUSD currency pair.

Deposit and Withdrawal Fees – Roboforex does not charge any deposit fees from its traders. Additionally, Roboforex also states that traders will be able to make all deposits without any commission. This means that Roboforex will reimburse the fees or commission charged by the payment service provider. Roboforex also allows two 0% commission withdrawals per month.

No Inactivity Fee – Roboforex does not charge an inactivity fee.

Overall, we consider Roboforex to be a medium-cost broker. While they charge tight spreads, they also charge a commission per trade. However, it is worth noting that they provide deposits at 0% commission including the commission charged by your payment service provider. Additionally, Roboforex does not charge an inactivity fee, unlike most similar brokers.

Roboforex Bonus

Roboforex offers a variety of bonuses and promotions from time to time in order to make their service more attractive to traders.

10 Years of Roboforex – The company is currently celebrating 10 years of being in operations. It is running a lottery in which it will give away $1 million in prizes to winning traders. The lottery depends on the stock trades made by the traders during the lottery period. The lottery is going to run between October 2020 and May 2021.

Welcome Bonus – Roboforex provides a welcome bonus of $30 to new traders. To avail of the bonus, traders need to make a minimum deposit of $10 to their trading account. The bonus is available only for traders using the Pro-Standard and Pro-Cent account types.

Profit Share Bonus – A profit share bonus of 60% is provided to traders after their first deposit. Traders will need to pass a simple verification process to be eligible for this bonus. The bonus is available only on Pro-Cent and Pro-Standard accounts.

Classic Bonus – A classic bonus of up to 120% is made available to traders after their first deposit. This bonus is only applicable to Pro-Standard and Pro-Cent account users.

Roboforex Deposit and Withdrawal

Malaysian traders can deposit and withdraw their funds in a variety of ways. Here are the ways in which funds can be deposited and withdrawn from a Roboforex trading account.

Local Bank Transfer – A local bank transfer can be made in MYR. The withdrawal commission is up to 4% for withdrawals made through this method. The processing time can take up to 1 day.

Electronic Payments – Roboforex accepts online payments from a variety of digital wallet services. These include Skrill, Neteller, Perfect Money, AdvCash, FasaPay, WeChat Pay, AstroPay and more. The processing time can take up to one business day. A commission is charged for making a withdrawal through these methods.

Debit and Credit Cards – Roboforex accepts payments through Debit and Credit Cards. They accept Visa, Mastercard, and JCB card issuers.

Roboforex does not accept payments through wire transfers.

It should be remembered that Roboforex offers 0% commission deposits including the commission charged by the payment service provider. Withdrawals can be for 0% commission for up to two withdrawals per month.

Roboforex Account Types

Roboforex offers 5 primary types of accounts to its traders. These are the Prime, ECN, R Trader, Pro-Cent, and Pro-Standard accounts.

The R Trader, Pro-Cent, and Pro-Standard account types can be converted into Islamic accounts that are swap-free.

Each type of account can be a demo account so that traders can test their strategies or practice trading.

Here is a breakdown of each account type offered by Roboforex.

Islamic Account – A trader can request the Roboforex customer support team to convert their account into an Islamic account. The Islamic account does not charge swap rates (or rollover interest). Instead, they charge a commission that is completely dependent on the type of currency pair and the number of open lots.

All other trading conditions remain the same under an Islamic account. As noted earlier, the R Trader, Pro-Cent, and Pro-Standard account types can be converted into Islamic accounts.

Prime Account – The Prime account provides the best trading conditions that are available from Roboforex. The Prime account is meant for experienced traders. The minimum deposit that needs to be made is $10. The spread starts from 0 pips.

The traders are also charged a commission per trade. The maximum leverage that can be used is 1:300.

ECN Account – The ECN accounts provide the tightest spread and the highest execution speed. This account is also meant for professionals. Traders are charged a floating spread that starts from 0 pips. They are also charged a commission per trade. The minimum deposit that needs to be made is $10. The maximum leverage that can be used is 1:500.

R Trader – The R Trader is a special account type that provides access to the widest range of trading instruments. Traders can choose from more than 12,000 trading instruments. The minimum deposit that needs to be made is $100. The spread starts from 0.01 USD. The maximum leverage that can be used is 1:300.

Pro-Cent – The main feature of the Pro-cent account is that it allows traders to use cents as a base currency (US cent, EU cent, etc.). This account is also appropriate for beginners while experienced traders can test their strategies.

The minimum deposit required is $10. Traders are not charged a commission when trading through this account type. The floating spread starts from 1.3 pips. The maximum leverage that can be used is 1:2000 (However, beginners should be careful when using leverage).

Pro-Standard – This is the most popular account available with Roboforex. It is suitable for both new and experienced traders. This account requires a minimum deposit of $10. The spread starts from 1.3 pips and traders are charged a commission. The maximum leverage available is 1:2000.

Roboforex Trading Instruments

The instruments that are available depend on the type of account being used by the trader. As mentioned earlier, the R Trader account provides the widest range of instruments. Traders have access to more than 12,000 instruments through the R Trader account which includes Indices, Cryptocurrencies, Real stocks, CFD on stocks, Forex and ETF, CFDs on Oil, CFDs on Metals.

Overall, Roboforex offers a wide range of trading instruments compared to other similar brokers. The broker also provides access to cryptocurrencies which is an advantage.

Roboforex Trading Platforms

Roboforex offers a wide range of trading platforms for traders to choose from.

MetaTrader 4 – The MetaTrader 4 is one of the most popular trading platforms in the forex market. It offers a range of customizable features and technical indicators. It is easy to use and provides fast order executions. The platform is available on computers, browsers, smartphones, and tablets.

MetaTrader 5 – The MT5 is the latest version of the MetaTrader. It can support advanced trading for a wider range of asset classes.

cTrader – The cTrader is another popular trading platform. The platform provides 54 technical indicators along with 14 timeframes.

R Trader – The R Trader is Roboforex’s proprietary trading platform. It is a multi-asset terminal. The R Trader is available in Malay. The trading platform provides “advanced watchlists” and the initial deposit needs to $100.

Roboforex Customer Support

Malaysian traders have the option of reaching Roboforex’s customer support team in a variety of ways. Users can reach out to customer support through live chat, email, or phone calls.

Live Chat – The live chat option can be accessed through Roboforex’s website. The live chat option is also available in Malay. We used the English chat option while writing this review and found them to be responsive and helpful. They took an average of 5 minutes to respond to our queries.

Email – Malaysian traders can also reach out to them through email.

Phone Call – Roboforex offers a dedicated Malaysian phone number for Malaysian traders to contact them.

Contact Form – There is a contact form available on their website for general queries.

Do We Recommend Roboforex Malaysia?

Yes, we recommend Roboforex for Malaysian traders.

They offer Islamic account and their services are available in Malay. We consider them to be a safe broker to trade through due to their brokerage license from the IFSC and track record.

They offer many types of trading platforms to their users. They also offer a wide range of trading instruments. A wide variety of account types are also available for different types of traders.

FAQs on RoboForex Review

Is RoboForex a trusted broker?

RoboForex is regulated by CySEC & IFSC so we are considering them as low-risk trading brokers. As RoboForex offers an Islamic account in Malay base currency so we recommend RoboForex to Malaysian Traders.

How to withdraw money from RoboForex?

Funds withdrawal requests can be submitted from the client panel under Withdraw Funds section. You can withdraw funds to the same account that was used for depositing.

What is RoboForex’s minimum deposit?

RoboForex’s minimum deposit amount varies depending on the type of trading account you choose. Here are the minimum deposit requirements for some of their account types:

- ProCent Account: $10 minimum deposit

- ProStandard Account: $10 minimum deposit

- ECN Account: $1,000 minimum deposit

- Prime Account: $5,000 minimum deposit

Roboforex Kenya